Southern Norway and Sweden saw really high prices driven by low Continental and Nordic wind power production and cold weather with high consumption in December 2024.

We expect similar situations to occur more and more frequently as we switch from a thermal driven system to a renewable-dominated system in Europe. Flexibility is a must, and Southern Norway could play a dominant role in offering hydro power to market during periods of low renewable generation.

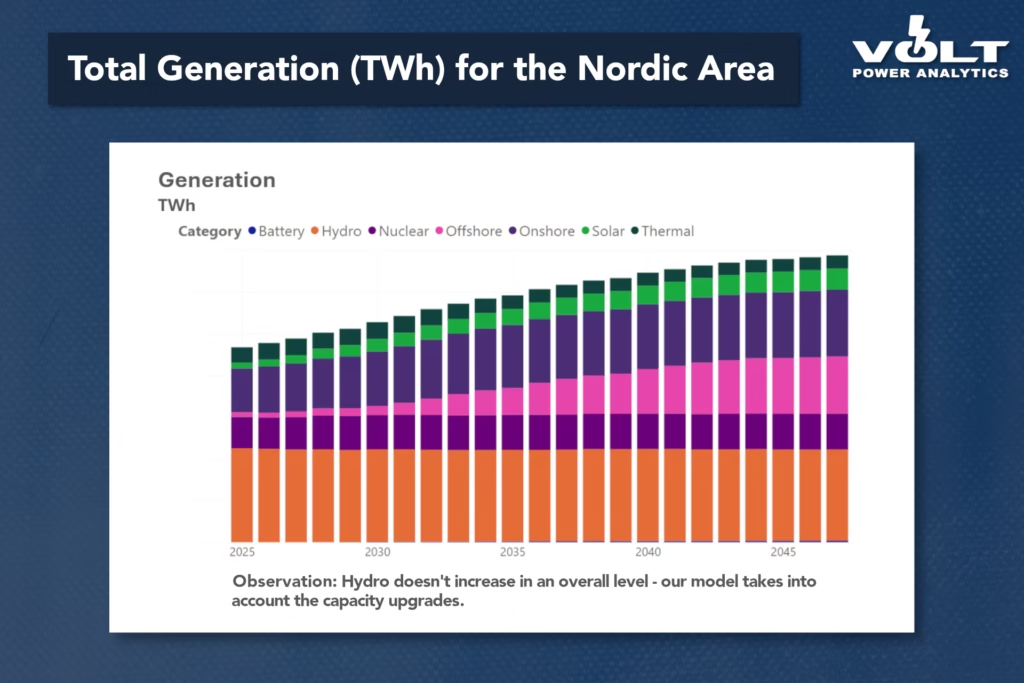

The question of capacity vs. energy is of increasing importance when looking ahead to 2050. When considering potentially profitable investments that can be done on a large-scale within the next few years, hydro capacity upgrades could provide the quick ramping needed to match consumption during hours of tight supply.

When evaluating the profitability of hydro capacity upgrades in our hourly resolution simulations for our 2050 outlook, we see that Southern Norwegian hydro producers could both alleviate the energy shortfall going forward while also optimizing their profits to cover their investment.

Our 2050 outlook is updated monthly and includes all the key features needed to evaluate investments in the Green Transition, including:

- Simulated negative prices in interaction with full battery optimization at an hourly level

- A perspective on hydro capacity upgrades

- An accurate description of Pan-European power market dynamics, including the impact of German solar on Nordic investments.