Volt has previously explored the buildout of data centres in the Nordics—but how will prices develop up until 2035?

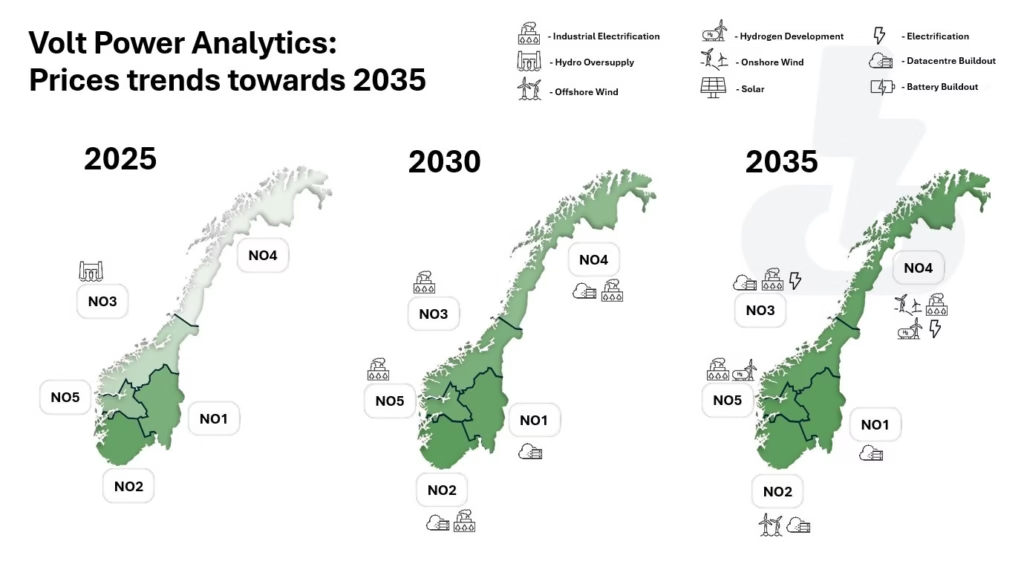

Our latest analysis reveals key shifts in Norway’s power market over the next decade:

Norway’s power surplus persists—but it’s shrinking. Data centres will be the dominant driver of consumption growth, increasing demand relatively quickly and putting pressure on the power balance whilst triggering investments in new green production.

Traditional electrification takes a back seat. Industrial electrification will account for a relatively small share of consumption growth compared to data centres. Electrolysis projects face delays and won’t become significant until the 2040s.

Continental dynamics reshape trade flows. Interconnections from NO2 will operate more in balance between import and export hours, driven by high renewable development on the continent and increasing volatility.

Norwegian prices converge long-term. As the market matures, regional price differences will narrow.

Interested in discussing Norway’s power market evolution? Get in contact!