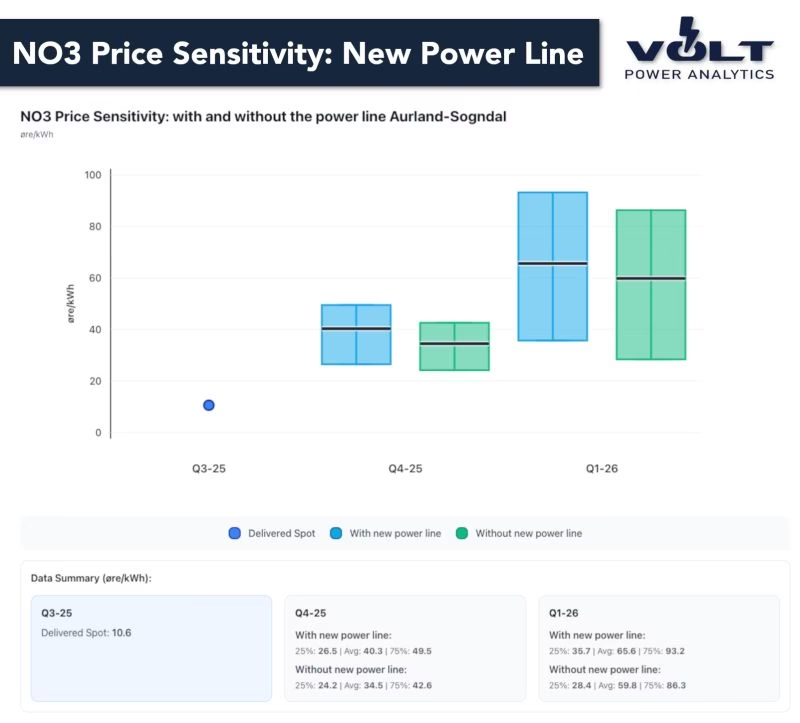

We are moving out of a historic low-price period in NO3 with Q3-25 delivered at just 10.6 øre/kWh into a period of higher consumption and increased connectivity to southern Norway. From this autumn and into winter, prices in NO3 were expected to rise regardless of the new power line, but the stronger link south pushes them a bit higher. By Q1-26 we project 65.6 øre/kWh on average, while without the new power line our estimates showed 59.8 øre/kWh. The financial power market also sees a price hike ahead, with Q1-26 currently at 51.7 øre/kWh — but still below our view at Volt Power Analytics.

Hydrology is still king. NO3 has healthy reservoirs, while a surplus in NO4 keeps cheap power flowing into NO3, temporarily dampening the effect of the reinforcement. If precipitation drops below normal, prices could climb quickly in both zones. The upside risk for NO3 is clear: with extremes showing as high as 93.2 øre/ kWh in Q1-26 if we get a dry, cold winter. The coming weeks will be critical as hydropower producers in NO3 adapt to a new market reality with stronger ties southward.

Read more on Norsk rikskringkasting (NRK): https://lnkd.in/de6_RCH3

Link to LinkedIn post: https://tinyurl.com/mu33k6ae