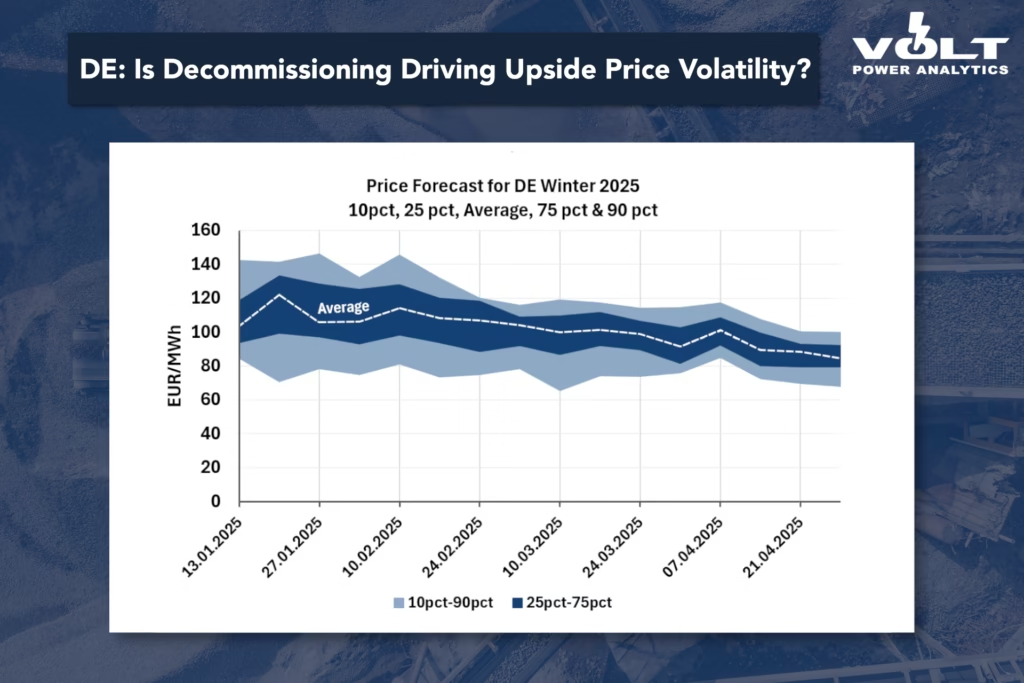

2024 showed a further emphasis on the green transition in Germany with yet a year of massive renewable buildout alongside 7 GW of thermal decommissioning of lignite, hard coal and gas power plants.

We observed direct consequences of this when the wind and solar power declined simultaneously as the cold snap hit leading to high consumption. The steep price increase on tightness of supply for some hours in Germany drove prices to records across Europe.

- What will the future bring for the mismatch between base load production and intermittent renewable generation?

- Can thermal going forward even tighten the gap from periodically staggering renewable production?

- How much further will we see thermal decommissioning alongside a rapid build out of renewables?

- How much battery capacity is needed and is this even a viable solution as energy needs to be stored over the longer periods of a cold snap?

In our long-term analysis, the data shows that we need to offer flexibility in consumption in the shape of battery capacity across Europe and electrolyser capacity to stabilize the grid during periods of high renewable production.

The storage dilemma and complexity of the power market towards 2050 looks to be evermore increasing 📈