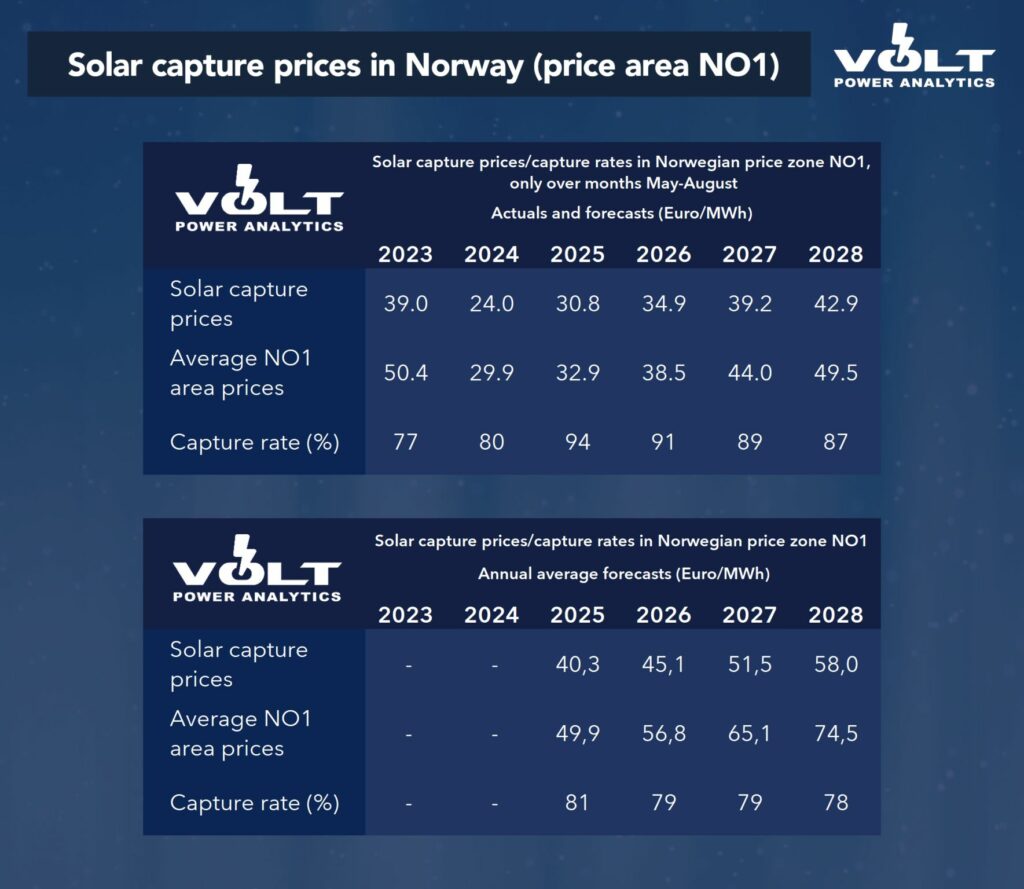

Booming solar PV production across Europe has led to dwindling capture prices and rates. Our solar PV capture price based on our hourly EMPS price forecasts shows that the Oslo price area (NO1) could be an exception.

When looking at the average of the months from May to August for 2023-2028, we see an increase in capture rates from around 80% to almost 90%. This is due to our assumption of strong growth in electricity consumption in the Nordic countries throughout the period.

When looking at the same calculations on a full-year basis, the capture prices are significantly higher if the remaining months of low production levels are included. Capture rates, however, are slightly lower, at around 80% over the whole period.

What does this mean in the context of the profitability of solar investments? Compared to the LCOE for solar power generation in Norway (based on NVE, updated to October 2024 and converted to EUR/MWh), we find the economic viability of the installations challenging.

The LCOE for ground-mounted solar is close to 55 €/MWh, for large rooftops 65 €/MWh, and for residential rooftops close to 100 €/MWh.